COPING WITH COVID-19 BUSINESS RISKS

Strong, effective credit risk management is needed to reduce exposure and steer your business performance through increasingly uncertain markets. Business operations and decision making must change to adapt to current risks!

As companies all over the world try to cope with the economic consequences of Covid-19, there is increased interest in implementing a strong, effective credit risk management system. Solutions are needed which offer permanent monitoring of all your counterparties (customers, vendors, suppliers and partners) to detect changes in their financial strength. In this environment it is imperative to maintain a comprehensive understanding of financial position strength of your counterparties!

Global Credit Services provides the financial risk scores, data, reports and tools needed to enhance your current risk procedures and create a strong, effective credit risk management system.

Make smarter, faster risk decisions with Global Credit Services

- All you need to improve your decision making: risk reports and scores, financial data and reports, business news alerts and more

- Credit Opinions prepared by our Credit Analysts for Retailers and Wholesalers (the hardest hit sectors)

- Rely on risk scores based on industry-specific scoring models, using disciplined methodology and unbiased analysis

- Skip the complexity of crunching numbers and studying data – see immediate results

New COVID-19 Financial Line Items

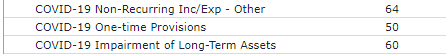

- Six new COVID-related line items have been added to Detailed Fundamentals, where applicable, to highlight Covid-related unusual/non-recurring expenses.

- COVID-19 Income Taxes – non-Recurring

- COVID-19 One-time Government Grants

- COVID-19 Impairment of Long-Term Assets

- COVID-19 Restructuring Chrgs

- COVID-19 Non-Recurring Inc

- COVID-19 One-time Provisions

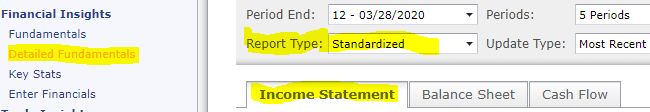

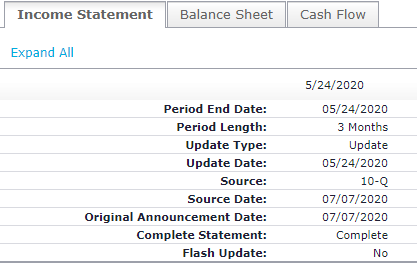

- This data is added to the Detailed Fundamentals financials: view with the following report settings:

- Report Type - Standardized

- Statement Type – Income Statement

Important Note - SEC Guidance related to COVID-19! !

The SEC recently provided guidance related to these disclosures and encouraged companies to make these COVID-19 disclosures. Such disclosures include:

- evaluate and disclose management’s assessment of the current and expected impact of COVID-19 on company operations

- disclose overall liquidity position and outlook related to the extent COVID-19 is adversely impacting revenue, cash flow, access to traditional funding sources

- disclose risks related to timely service of debt obligations and inability to meet current covenants in lending agreements

The implications of this disclosure information will be discussed in the Analyst Credit Reports for Retailers and Wholesalers, the sectors with the greatest risk profile. In Addition, these disclosures will be included in the MDA discussion and other sections of SEC quarterly filings for all companies.

Take a look at Global Credit Services – it will transform how you measure, evaluate and manage financial risk.

To learn more call us at: 917-388-8800